Below you will find the latest Medicare facts and figures.

2024 Updates to Medicare for You: A Smart Person’s Guide

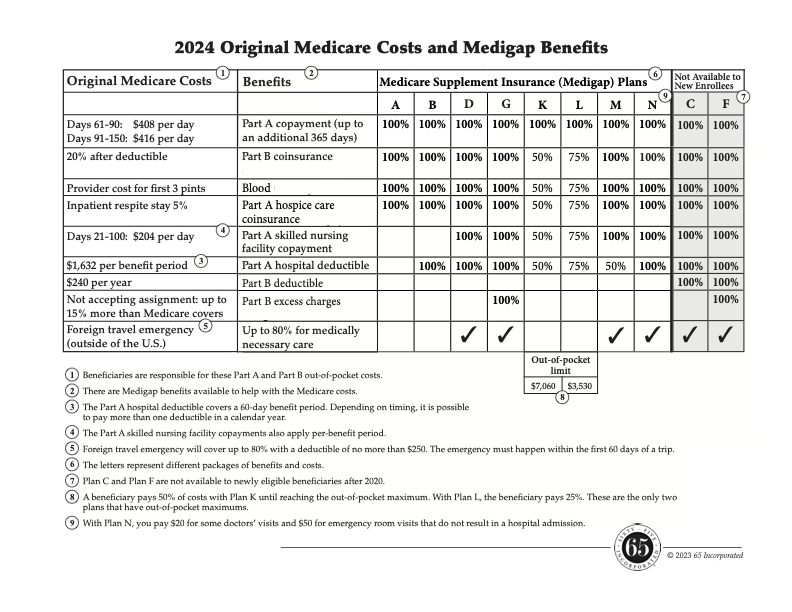

Original Medicare Costs

UPDATED FACT: The Part B deductible is $240.

SECTIONS WHERE IT APPEARS:

- Shopping for Coverage: Questions and Answers about a Medicare Advantage Plan

- Shopping for Coverage: Questions and Answers about a Medigap Policy

- Living with Medicare: Part B, Medical Insurance

UPDATED FACT: The Part A hospital deductible is $1,632 per benefit period.

SECTIONS WHERE IT APPEARS IN THE BOOK:

- The Parts and Paths of Medicare: Medicare Costs and the Need for Additional Coverage

- Living with Medicare: Part A, Hospital Insurance

- Living with Medicare: Questions and Answers about Part A and Part B Services

UPDATED FACT: Extended hospitalization copayment is $408 for days 61–90 in a benefit period, and $816 per day for days 90–150 (lifetime reserve days).

SECTIONS WHERE IT APPEARS:

- The Parts and Paths of Medicare: Medicare Costs and the Need for Additional Coverage

- Living with Medicare: Part A, Hospital Insurance

- iving with Medicare: Questions and Answers about Part A and Part B Services

UPDATED FACT: The skilled nursing facility (SNF) copayment is $204 for days 21–100.

SECTIONS WHERE IT APPEARS:

- The Parts and Paths of Medicare: Medicare Costs and the Need for Additional Coverage

- Living with Medicare: Part A, Hospital Insurance

Part D, Prescription Drug Coverage

UPDATED FACTS:

- The standard Part D deductible is $545.

- The threshold to enter the next stage, Coverage Gap (donut hole), is $5,030.

- Once your true (total) out-of-pocket costs (what you’ve paid in the Coverage Gap) reach $8,000, it’s on to the last payment stage, Catastrophic Coverage. Once hitting the threshold, there are no costs for medications in Catastrophic Coverage.

SECTION WHERE THEY APPEAR:

- Living with Medicare: Part D, Prescription Drug Coverage

UPDATED FACT: Those in a nursing home have opportunities to switch Medicare drug coverage outside regular enrollment periods. Specifically, they can change drug plans:

- upon admission to a nursing home

- once a month while living in the nursing home, and

- during the two months after discharge from the facility

SECTION WHERE IT APPEARS:

- Other Important Things You Need to Know: Open Enrollment and Changing Plans

Medigap Policies (Medicare Supplement Insurance)

UPDATED FACT: Medigap policies in 47 states are standardized by 10 letters. Each letter represents a package of benefits and costs. Massachusetts, Minnesota, and Wisconsin have their own models, but the policies work the same way.

SECTION WHERE IT APPEARS:

- The Paths and Parts of Medicare: Original Medicare Path

UPDATED FACT: The deductible for high-deductible Plan G is $2,800.

SECTION WHERE IT APPEARS:

- Shopping for Coverage: Shopping for a Medigap Policy

UPDATED FACT: There are now eight states–California, Idaho, Illinois, Kentucky, Louisiana , Maryland, Nevada, and Oregon–with a birthday rule, allowing those who have a Medigap plan to make a change during a period related to their birthday.

SECTION WHERE IT APPEARS:

- Other Important Things You Need to Know: Open Enrollment and Changing Plans

Medicare Advantage Plans

UPDATED FACT: The maximum out-of-pocket limit in 2024 is $8,550 for in-network care and $13,300.

SECTIONS WHERE IT APPEARS:

- The Parts and Paths of Medicare: The Three Parts of Medicare and Costs Overview

- The Parts and Paths of Medicare: Questions and Answers about the Medicare Paths

- The Parts and Paths of Medicare: Questions and Answers about Your Medicare Path Decision

- Living with Medicare: Questions and Answers about Your Medicare Path

UPDATED FACT: According to Q1Medicare.com, there is only one MSA plan left in the country and that is in Wisconsin. The deductible is $5,100.

SECTION WHERE IT APPEARS:

- Shopping for Coverage: Shopping for a Medicare Advantage Plan

UPDATED FACT:

In 2024, there are 31 Medicare Advantage plans that received a 5-star rating. These ratings have declined in recent years. In 2022, there were 74 plans with five stars and 57 in 2023. There are two 5-star Part D drug plans in 2024, down from 10 in 2022.

SECTION WHERE IT APPEARS:

- Questions and Answers about Part D Prescription Drug Coverage

- Shopping for Coverage: Shopping for a Medicare Advantage Plan

- Other Important Things You Need to Know: Open Enrollment and Changing Plans

UPDATE: A Worrisome Trend: Health Systems Dropping Medicare Advantage Plans

In fall 2023, Becker’s Hospital Review reported that 15 health systems across the country are discontinuing their Medicare Advantage contracts. The key issues driving these decisions include low reimbursement rates and/or delays in getting paid, prior authorization, denial rates, and administrative costs to manage out-of-network care. The number of contracts being dropped ranges from just one to many. For instance, over 30,000 Medicare Advantage plan members had to scramble to find new health care providers when their specialty health system dropped Medicare Advantage. Those who have been enrolled in Part B for more than six months no longer have a guaranteed issue right and, in most states, would likely need to pass medical underwriting to get a Medigap policy.

No one knows whether more health systems will join this trend or if it will fade away, but this is a factor to consider when making your path decision.

This issue does not have an impact on those who choose the Original Medicare Path.

SECTION WHERE IT APPEARS:

- The Parts and Paths of Medicare: Making Your Medicare Path Decision

UPDATE: PPO Plans and Prior Authorization

As with just about every Medicare Advantage plan, a PPO can require healthcare providers to obtain advance approval for any service. However, PPO plans cannot mandate this for out-of-network providers.

No prior authorization may sound amazing, but it really isn’t. Most plans will suggest that you ask for a pre-visit coverage decision to confirm that the out-of-network services you’re getting are covered and are medically necessary. This is important because, without this decision, the plan may determine (after the fact) the services were not covered or were not medically necessary. If that happens, you end up with the bill.

Here’s how to avoid those retroactive denials.

- Whenever possible, get necessary medical care from an in-network provider. Prior authorization is generally the provider’s responsibility.

- Examine your plan’s Evidence of Coverage (EOC) for information about prior authorization for out-of-network services.

- Ask a plan representative how to obtain a pre-visit coverage decision if you’re about to receive services from an out-of-network provider.

- File an appeal if your plan determines it won’t cover the care.

SECTION WHERE IT APPEARS:

The Parts and Paths of Medicare: Making Your Medicare Path Decision

UPDATE: Your Flexibility

- Once you have enrolled in a Medigap policy, about the only thing that will change is your premiums. Pay them timely and the coverage is guaranteed renewable. You will have to review your Part D drug plan every year during Open Enrollment.

- Many things can change about a Medicare Advantage plan, including the premiums, benefits, coverage rules, and, most significantly, the networks. There are two open enrollment periods every year that give you the opportunity to review your coverage.

SECTION WHERE IT APPEARS:

- The Parts and Paths of Medicare: Making Your Medicare Path Decision

UPDATE: Medicare Advantage Commercials

Up through the end of 2023, we were inundated with commercials talking about the benefits you deserve, that you should be getting. But then, the rules changed. CMS had to approve every commercial and, suddenly, many of the claims disappeared. However, it’s still important to know the facts about free rides to medical appointments, preventive services, no premiums, and the Medicare giveback.

FYI: The maximum giveback amount allowed is the Part B premium, $174.70 in 2024. I have not found a plan that offers that amount. Many givebacks range from $20 to $65.

SECTION WHERE THIS APPEARS:

- The Parts And Paths Of Medicare: Medicare Advantage Commercials

Medicare Premiums

UPDATED FACT: The Part B premium is $174.70.

SECTIONS WHERE IT APPEARS:

- The Parts and Paths of Medicare: The Three Parts of Medicare and Costs Overview

- The Parts and Paths of Medicare: Federal Employees Health Benefits (FEHB) Plans

- Medicare Premiums: Premiums for Medicare Coverage

- Medicare Premiums: Questions and Answers about Medicare Premiums

UPDATED FACT: Those who do not qualify for premium-free Part A and have earned 30 credits will pay $278 a month. Those with fewer than 30 credits will pay $505.

SECTION WHERE IT APPEARS:

- Medicare Premiums: Premiums for Medicare Coverage

UPDATED FACT: The premiums for stand-alone Part D drug plan start as low as $0.00 in a few areas and go up to $100 or more.

SECTION WHERE IT APPEARS:

- Living with Medicare: Part D, Prescription Drug Coverage

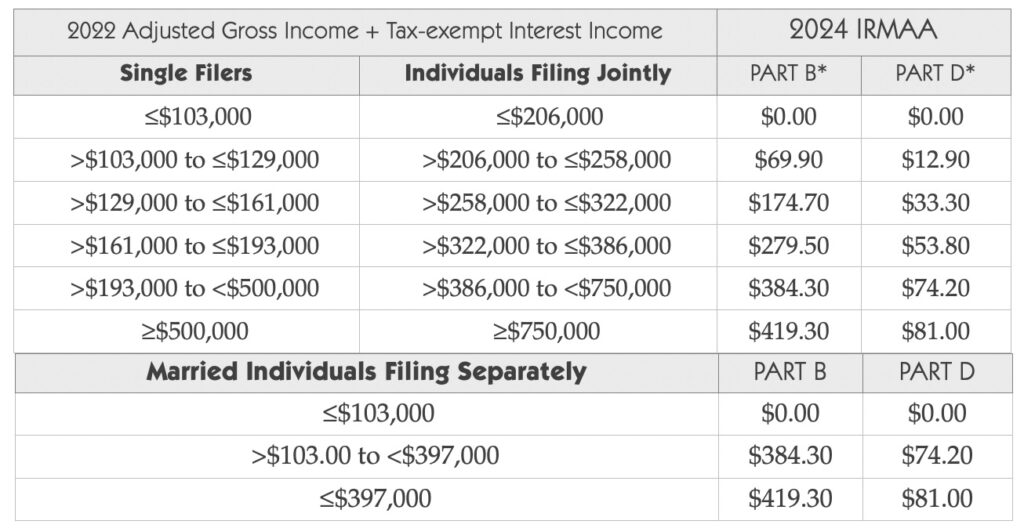

IRMAA (Income-related Monthly Adjustment Amount)

UPDATED FACTS:

- For those enrolling in Medicare Part B in 2024, Social Security reviews their 2022 tax records.

- The IRMAA thresholds are as follows $206,000 for a married individual filing a joint return (both spouses will have to pay any adjustments), $103,000 for a single filer, and $103,000 for a married individual filing a separate return.

SECTION WHERE THEY APPEAR:

- Medicare Premiums: IRMAA

Late Enrollment Penalties

UPDATED FACTS:

- The Part B late enrollment penalty is 10 percent of the standard Part B premium for every year (a full 12 months) enrollment is delayed. In 2024, the penalty amount was $17.47 (10 percent of $174.70. Three years late enrolling in Part B added $52.41 to the monthly premium.

- The Part D late enrollment penalty amount is $0.347 (1 percent of $34.70) for each month without drug coverage.

- Part A late enrollment penalty amount in 2023 for those who have 30–39 credits is $27.80 and $50.50 for those with fewer than 30 credits.

SECTION WHERE IT APPEARS:

- Determine Your Timing: Questions and Answers about the IEP

Skilled Nursing Facility

UPDATED FACT: During the COVID pandemic, Medicare temporarily waived the requirement for a three-day prior hospitalization for coverage of a SNF stay. This waiver provided temporary emergency coverage of SNF services without a qualifying hospital stay. This waiver has been extended multiple times and is now set to expire on April 11, 2023.

SECTION WHERE IT APPEARS:

- Living with Medicare: Skilled Nursing Facility (SNF) Stays

New in 2024

Here is a list of the most significant changes for 2024.

Part B Special Enrollment Period for Special Circumstances.

Missing the chance to enroll in Medicare can be devastating. Until recently, those who did not enroll on time had little recourse, but things are beginning to change. Medicare now provides a Part B special enrollment period for exceptional circumstances, which include:

- misinformation from an employer

- an emergency or natural disaster

- a release from a correctional facility

- termination of Medicaid eligibility, and

- other exceptional circumstances.

Remember to document all the details.

SECTION WHERE THIS WOULD APPEAR:

- Get Ready for Medicare: Tips to Help You Get Ready

The Inflation Reduction Act and Part D Drug Coverage

The Inflation Reduction Act (IRA) of 2022 has many goals: fight inflation, invest in domestic energy production and manufacturing, reduce carbon emissions, and extend the Affordable Care Act. Some of the most significant changes may be with Medicare drug coverage. Here’s a summary.

Insulin

All insulins covered under a Part D plan, whether injected or administered by pump, are now capped at $35. Just to get an idea of the savings, 3.3 million beneficiaries with Part D coverage in 2020 spent $1 billion out of pocket on insulin.

Note this important point: CMS defines “covered” as an insulin that is included on a Part D sponsor’s formulary, the list of drugs it covers. Plans can determine the drugs they cover and can change their formularies.

This new rule created issues during the 2023 Open Enrollment Period. 65 Incorporated found that 10 plans (out of 22 in two areas) will cover fewer insulins in 2024. For instance, four plans will drop four insulins from their formularies.

Medicare beneficiaries with diabetes should check during the Open Enrollment Period that their Part D plans will cover their insulin each and every year.

SECTIONS WHERE THIS WOULD APPEAR:

- Living with Medicare: Part B, Medical Insurance

- Living with Medicare: Part D, Prescription Drug Coverage

Part D Vaccinations

Part B covers many vaccines, such as those for the flu, pneumonia, and COVID, to name a few. Part D covers just about every other vaccine. These include the following:

- shingles (known as Shingrix)

- hepatitis B administered to non-high-risk individuals

- DTaP (diphtheria, tetanus, pertussis), and

- RSV (respiratory syncytial virus).

Part D vaccinations are now treated just like Part B vaccines. They are not subject to a plan’s deductible and there is no copayment.

Getting Part D vaccinations in a physician’s office can create problems, no matter the Medicare path you chose. To avoid issues, visit a pharmacy that is in the drug plan’s network. Many pharmacies will allow you to schedule an appointment for your visit.

SECTIONS WHERE IT APPEARS:

- Living with Medicare: Part D, Prescription Drug Coverage

- Living with Medicare: Questions and Answers about Part D Drug Coverage

Catastrophic Coverage Coinsurance

This is the fourth payment stage in a Part D drug plan. Those who reached this stage had to pay 5 percent of the cost for brand-name and specialty medications, with no limit on out-of-pocket costs. The IRA eliminated this coinsurance so those who reach Catastrophic Coverage have no drug costs for the remainder of the year. In 2024, this will save 1.5 million drug plan enrollees (4 percent of those not receiving extra help) about $3,100 in out-of-pocket costs. That adds up to $4.65 billion that Part D drug plans will now have to pay, causing some ripple effects.

Here are some findings from a review of plans in three ZIP codes.

- Many plans increased the copayments for Tier 1 and Tier 2 drugs.

- Some changed a Tier 3 copayment to a coinsurance. One example: A popular, TV-advertised anticoagulant medication, a Tier 3 drug, had a copayment of $47 in 2023. This is now a 25% coinsurance, which increases cost sharing by $91 a month initially (retail price of $550). And this out-of-pocket cost will go up as the drug price increases.

- Plans are also increasing the coinsurance for Tier 4 and Tier 5 drugs.

SECTION WHERE THIS WOULD APPEAR:

Living with Medicare: Part D, Prescription Drug Coverage

Premium Stabilization

You may have seen recent headlines that Part D plan premiums now have a cap on annual increases and cannot increase more than 6 percent annually. And then, along came the 2023 Annual Notice of Changes with premium increases of 25 percent, 39 percent, even 75 percent. So, what’s going on?

As of January 1, 2024, the IRA limits the Part D base beneficiary premium to a six percent increase over the previous year. The base premium is a starting point for calculating plan-specific basic Part D premiums and the basis of the Part D late enrollment penalty calculations. It is not the one a beneficiary will pay and that is why premiums vary considerably and can go up more than six percent.

SECTION WHERE THIS WOULD APPEAR:

- Living with Medicare: Part D, Prescription Drug Coverage

- Shopping for Coverage: Shopping for Part D, Prescription Drug Coverage

Coming in 2025

There are more IRA changes slated for 2025.

- The donut hole will disappear. Drug plan members will have the same cost sharing until reaching Catastrophic Coverage.

- Part D enrollees will be able to spread their out-of-pocket costs over the year rather than face high out-of-pocket costs in any given month, especially January when deductibles come into play.

- There will be a $2,000 cap on drug costs that will be indexed annually.

- Drug plans will pay a higher share of drug costs in the catastrophic phase.

SECTION WHERE THIS WOULD APPEAR:

- Living with Medicare: Part D, Prescription Drug Coverage

United States Postal Service (USPS) Employees and Annuitants

USPS employees, annuitants, and eligible family members have Federal Employee Health Benefits (FEHB) plans now but, as of January 1, 2025, that changes. The new Postal Service Health Benefits (PSHB) Program will sponsor their plans. The Office of Personnel Management website has fact sheets and FAQs to guide you.

Here are a few introductory points.

- If you are an annuitant as of January 1, 2025, and not currently enrolled in Part B, you will not need to enroll to continue with new PSHB coverage. You and your eligible family members may qualify for a special enrollment period, beginning in April, that will allow you to enroll in Part B without penalty.

- If you are an annuitant enrolled in Part B, you must maintain enrollment to qualify for the PSHB program.

- If you are an active employee under the age of 64 as of January 1, 2025, you will be required to enroll in Part B after retirement and eligible for Medicare.

What Should You Do? - Watch for more information, new plans, and the requirements during this year.

- If you have an FEHB plan, select a new PSHB plan during the 2024 open season.

- Determine the Part B rules that apply to you and take appropriate action.

- Bookmark www.opm.gov/healthcare-insurance/pshb, a good site for updates.

- SECTIONS WHERE THIS WOULD APPEAR:

- Determine Your Timing: Keeping Employer Group Coverage Past Age 65

- The Parts and Paths of Medicare: Know When You Need More Help

Medicare Coverage Updates

Dental Services

Medicare now covers the following medically necessary dental services:

- diagnostic and treatment services for infection prior to or with any organ transplant

- reduction of jaw fractures

- oral health services in head and neck cancers, and

- ancillary services incident to these covered services, such as dental x-rays and operating room use.

SECTION WHERE IT APPEARS:

- Living with Medicare: Other Coverage Concerns

Hearing Exams and Hearing Aids

Over-the counter hearing aids are now available as a cost-effective alternative. No prescription is needed.

SECTION WHERE IT APPEARS:

- Living with Medicare: Other Coverage Concerns

Telehealth

Note this important change. Through December 31, 2024, those who have chosen the Original Medicare Path can get telehealth services at any location in the U.S., including their homes. After this period, services will be available only at an office or medical facility located in a rural area.

SECTION WHERE IT APPEARS:

- Living with Medicare: Part B, Medical Insurance

Preventive Services

Will Medicare cover CologardTM?

Medicare Part B will cover this screening test once every three years for those who show no signs or symptoms of colorectal disease and have no significant, repeated personal or family history.

Discuss any concerns with your physician.

SECTION WHERE IT APPEARS:

- Living with Medicare: Questions about Part A and Part B Services

Retiree Plans

Since the publication of Medicare for You, retiree coverage has undergone many changes. Here’s an overview of today’s situation.

Fewer than 15 percent of large employers offer retiree coverage. The plans may come with discounted premiums or cost sharing and benefits not available to the public. In many cases, the retirees have earned this coverage, may be vested, or have a fund of money, possibly from unused sick days or subsidies, to apply toward the costs.

As previously discussed, retirees must enroll in Part A and Part B during their IEP or SEP. How the retiree group health coverage coordinates with Medicare depends on the terms of the specific plan. For years, retiree plans served as the secondary payer to Medicare, covering costs such as the hospital deductible and 20 percent Part B coinsurance. Retirees had their choice of any physicians who saw Medicare patients.

But recently, Medicare Advantage has taken over. Half of the companies offering retiree coverage do it through Medicare Advantage plans. Employers can save money, primarily because they receive federal payments. Retirees must understand how the coverage works. The plans have networks. Most employers offer preferred provider organization (PPO) plans and many services will require prior authorization.

With retiree coverage, the plan sponsor controls the coverage and can change the structure, costs, or whatever else. What if the group coverage no longer works for the retiree? Perhaps the plan’s network limits the ability to choose physicians, prior authorization rules delay necessary care, or customer service never answers the phone. These problems can lead to buyers’ remorse.

Unhappy retirees could opt out of the coverage and choose a Medicare option available to the public, either a Medicare Advantage plan or a Medigap policy (Medicare supplement plan) and Part D drug plan. However, those who had been enrolled in Part B for more than six months no longer have a guaranteed issue right to get a Medigap policy. They would likely need to pass medical underwriting to purchase a policy.

If that happens, the retiree’s options to change coverage depend on the situation.

SECTION WHERE IT APPEARS:

- The Parts and Paths of Medicare: Know When You Need More Help

Clarification

Medicare Advantage plans must provide the same Part A and Part B services that Original Medicare covers, but plans can set the rules and determine how to operate. There are three coverage rules of consequence: networks, referrals, and prior authorization.

SECTION WHERE IT APPEARS:

- The Paths and Parts of Medicare: Medicare Advantage Path

Clarification

The IEP, seven months surrounding your 65th birthday, is a time to pay attention to Medicare.

Once you turn 64, use one of these worksheets to identify your IEP. Then, during this time, study your situation and determine what, if anything, you need to do about Medicare.

SECTION WHERE IT APPEARS :

- Appendix: Initial Enrollment Period (IEP) Worksheets

Significant Changes That Occurred in 2023

- A law that took effect in 2022 requires insurance agents, brokers, and other third-party marketing organizations (like the ones that sponsor TV ads) to record all calls with beneficiaries in their entirety, including the enrollment process. They must disclose that their information will go to an agent for future contact, and they may be transferred to an agent who can enroll them in a plan.

- As of January 1, 2023, the Centers for Medicare and Medicaid Services must approve all television ads in advance and review ads already on air to ensure they meet all marketing requirement

SECTIONS WHERE THIS WOULD APPEAR:

- The Parts and Paths of Medicare: Medicare Advantage Commercials

- Shopping for Coverage: Shopping for a Medicare Advantage Plan